- Free Program Bankable Project Proposal Template Download

- Free Program Bankable Project Proposal Template For Their Eyes Were Watching God

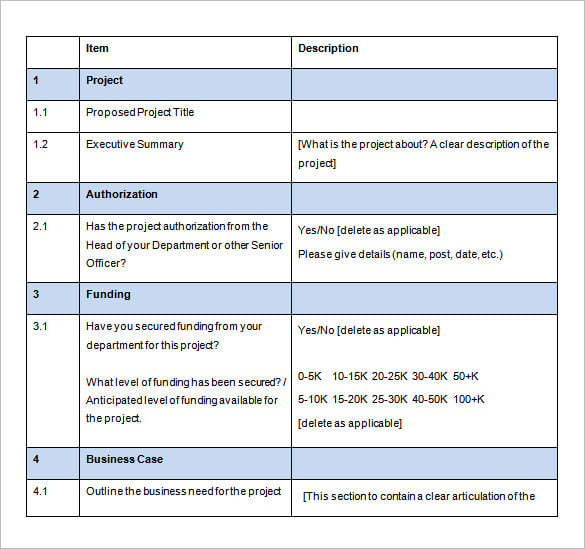

- Project Proposal Template Word

INTRODUCTIONCompany profilePartner historiesLOAN REQUESTAmountRepaymentCollateralFinancial statementsProjectionsWhat is a bank loan proposal?A bank loan proposal is a document used by prospective borrowers to apply for a bank loan and includes details such as how much you want to borrow, why you are borrowing, how you will repay, and other essential information. INTRODUCTIONDear Lender.FirstName Lender.LastName,I have been in the restaurant industry for more than two decades, holding positions from the front of the house to the back of the house. I’ve worked in several major U.S. Markets, including New York City and the San Francisco Bay Area, and overseas in South America and Europe.I first started out in my grandfather’s restaurant busing tables and doing dishes, and for the past 5 years I have been the manager of a highly acclaimed and popular destination restaurant in San Francisco.

I also hold a Bachelor’s Degree in Food Business Management from the Culinary Institute of America.PandaTip: The introduction section should be treated like an executive summary with a human touch. Explain who you are, your background and qualifications, the type of business you want to start, and where the loan money will be used. Be concise but informative.

And include a photo of yourself to personalize your proposal.Since those early days in grandpa’s kitchen, I have wanted to run my own restaurant. I believe my time is now, as I have the necessary experience, industry relationships and connections to make this happen. With help from those industry connections, I’ve created a sound business plan that borrows from established ventures but takes things a step further.The following proposal will show Lender.Company why I need a loan to launch my restaurant and how the money will be used to complement my existing capital.Sincerely,Sender.FirstName Sender.LastName Company profilePandaTip: Give the lender a sense of your business’s history and where it stands today, along with your market, target clientele, and overall industry. This will show your lender that you are qualified to do business in your desired industry.

Also include applicable photos, such as your logo or an interior shot of your business, your staff members, or renderings you might have created.At its core, a restaurant is a gathering place to relax, refuel, and commiserate with others. The world is full of different cultures, but one thing we all share are meals together. I’ve taken this ethos to heart, and it is the driving force behind my concept for a restaurant.In San Francisco, it’s not enough to just serve good food; you are selling an experience as much as a meal. The city is one of the top markets for restaurants in the country. It was one of the first two regions, along with New York, in the U.S. Reviewed by Europe’s esteemed Michellin Guide, and it contains the most restaurants per capita of any U.S. In essence, San Francisco is a trend-setter in the food world.My restaurant is currently in the buildout phase, with an anticipated opening date of six months from now.

We have secured a lease in a space in a neighborhood that has steady foot traffic, is popular with tourists and locals, and does not have any similar restaurants already. The space will be bright and open, with an exposed kitchen in the rear to show off food production and a 360 degree bar in the center with ample space to wait for a table and have a drink. We are aiming for seating of up to 50 at a time in order to give patrons a more personal experience.We envision a younger clientele, with plenty of out-of-towners due to the neighborhood being popular with tourists. Our prices will be very competitive in order to attract customers, but I also believe in living wages and benefits for our employees. To this end, all tips generated by the service staff are pooled together and dispersed equally depending on each employee’s function in the overall operation of the restaurant.

Partner historiesThere are two more investors in my restaurant, in addition to myself. We each bring something unique to the concept, all having spent our careers in the restaurant industry.One investor is a veteran in beer, wine, and spirits who runs a bar consulting business in San Francisco. He has helped open some of the cities most popular and well-respected establishments.

He has also won numerous industry awards. His focus is on using fresh ingredients to craft cocktails that pair well with food.The other investor is a seasoned chef who has worked for some of the finest restaurants in the U.S. For two decades. He studied cooking in France, and held two apprenticeships in Spain.

Free Program Bankable Project Proposal Template Download

His food has been lauded as “cutting-edge California cuisines.”I bring to the team the front-of-house experience, handling the direct contact with customers and managing the service staff. I have over 10 years of direct restaurant management experience at high-volume locations in San Francisco and New York. LOAN REQUEST AmountPandaTip: Tell your potential lender how much you need and why. Give specifics about how the money will be used and how you arrived at that particular figure.Our budget for the restaurant is $250,000.

Of that, the three investors including myself have raised $125,000, meaning we need another $125,000 to launch the restaurant. Our existing investment is being used to pay lease costs on the space while it’s built out and construction expenses to renovate the interior.

It’s also going toward city and state permit and licensing costs associated with restaurant and bar operations. As stated previously, we anticipate an opening date of six months from now.The money we are requesting from Lender.Company will go toward the following needs:. Kitchen equipment, $75,000: We believe quality food comes from good products. We need to purchase general cooking utensils, tableware and silverware, a new industrial-size oven with a 10-top burner, and refrigeration equipment. Bar equipment, $25,000: Our bar will use only the finest ingredients and spirits available, in addition to a small and well-curated beer and wine list. We have established relationships with beverage industry distributors for these products at competitive rates.

Food, $25,000: No restaurant is complete without its menu. Through our years of experience and vast connections, we have established relationships with food purveyors around the state of California and elsewhere in the U.S. To supply the restaurant.

These products will be the last items ordered before opening.RepaymentPandaTip: Tell your lender what kind of loan you desire and the terms for repayment, such as the interest rate. You also want to show how you will repay the loan based on sales and cash flow projections.

If you are unsure of what to expect, do some online research and expect to negotiate with the lender.We are asking Lender.Company for a loan of $125,000 to be repaid over one year at a rate of 6% interest, making payments of $11,041.67 monthly.Our estimates for revenue are an average of $6,000 per day over 22 operational days per month for a total revenue stream of $132,000 a month. After factoring in staff costs of $25,000 per month and operational costs of $75,000, we are left with enough money to comfortably repay a loan under those terms.

CollateralPandaTip: Lenders will ask for security for your loan. Collateral is essentially insurance for the lender in case cash flow projections don’t materialize. You and your business partners will need to put together assets that can be used as collateral. This can be done in a simple Excel-style spreadsheet and should be attached to your loan request proposal.Spreadsheets for each partner are attached showing various forms of collateral we are putting up as security for our loan request. Among them are mutual fund investments, equity from ownership of two separate residential properties, and savings accounts. Financial statementsPandaTip: These are more documents that you will need to attach with your loan request.

Each partner/investor in your business who has more than a 20% stake should include personal financial statements that are less than 90 days old. You also might be asked for tax return documents for up to three years. As for the business financial statements, if you are asking for a loan for an existing business, then include balance sheets, income statements, and reconciliation of net worth for a three-year period. If you are requesting a loan to launch a business, then include projections of income and a balance sheet.Attached to this loan request are personal and business financial statements for each partner. ProjectionsPandaTip: You should give your potential lender income and cash flow projections if you’re requesting a loan for a new business, or existing documentation showing that if your loan is for an existing business. You will also want to show your lender how you will adjust operations in the event your projections do not materializeOther documentation attached to this request includes income and cash flow projections for the restaurant, and alternative operational structures in the event our projections do not materialize.

If you are looking for an investment proposal to help pitch your business in order to gain that little (or large) amount of more funding that you need to go 'live' or keep your business going, use this free and customizable proposable to get your idea of the ground or to help keep it running.DisclaimerParties other than PandaDoc may provide products, services, recommendations, or views on PandaDoc’s site (“Third Party Materials”). PandaDoc is not responsible for examining or evaluating such Third Party Materials, and does not provide any warranties relating to the Third Party Materials. Links to such Third Party Materials are for your convenience and does not constitute an endorsement of such Third Party Materials.

If you're in the business of training or education, the odds are that you are perpetually seeking new clients. These days, the competition is fierce and more and more, you may be competing against low-cost online services. How do you make your services stand out from the crowd? You need to write a persuasive proposal to pitch your training services to new clients.Not a writer? Never written a proposal before? Creating a business proposal might sound intimidating, but it doesn't have to be an arduous task. As an expert in the training field, you already possess the skills you need.

A big part of writing a winning proposal is understanding structure and putting together a document that is easy to read and understand.Here's what you need to do in a proposal: introduce yourself, show that you understand your client's position, highlight your services, outline your costs, and help your clients understand you are the right person for the job. And you don't have to start off staring a blank page on your computer, either. You can use pre-designed templates and look at similar sample proposals to make the proposal writing process quick and efficient.Inexperienced proposal writers sometimes make the mistake of mailing out only a cover letter accompanied by a list of services and prices. That's not a good idea. Your goal is to persuade potential clients to give you their business.

And make them understand that you can deliver the services they need; a simple price list can never do that.As a trainer, you know that you must address the needs of your audience. That's true in a proposal, too.

Free Program Bankable Project Proposal Template For Their Eyes Were Watching God

So, to prepare for writing any kind of proposal, your first step should be to gather information about your client so that you can present a proposal tailored to meet that client's specific needs. Of course, that might take a bit of effort, but that research will make your proposal much more likely to pay off. Nobody likes to receive form letters; any client is much more likely to accept a customized proposal. Your time will be better served by learning about your potential client and structuring a proposal that specifically targets their needs than blanketing the field with a one-size-fits-all approach, or even an offer of multiple “packages.”After you've collected information about your potential client's history, needs, and concerns, you'll find that writing your training services proposal is a reasonably straightforward process. That's because proposals that offer services, regardless of the type of services, follow a similar structure: first comes the introduction, then a summary of the client's needs, followed by descriptions of the services offered, as well as details and costs. Then the proposal should conclude with information about the service provider, such as relevant experience, credentials, and capabilities.So, for the introduction section, create a Cover Letter and a Title Page.

The Cover Letter should deliver a personal introduction, provide your company contact information, and include a call to action - ask for the client's business or request a meeting. The Title Page should introduce your proposal with a title that indicates the project or scope of training services you are pitching. Some examples might be 'Training Your Staff on the Latest Office Software,' 'Mentoring Services for Helping Your Student Excel,' 'Hazardous Waste Handling Courses for Exaflow, Inc.,' or “Software Training for AB Call Center.”Following the Cover Letter and the Title Page, you'll add pages to show that you understand the needs and concerns of your client.

Depending on how large the proposed scope of work is, you may or may not need to precede the detailed pages with a brief summary. After providing the details of your training program, you need to persuade your client that you are the best choice for the job, so add pages like About Us / Company History, Experience, Our Clients, References, Credentials, Certifications, Awards, and Testimonials; in other words, include everything you need to convince your client that you can be trusted to deliver the training services needed. Finally, include one or two topic pages to wrap things up with a call to action. Use topics such as Recommendations or Evaluation.Training services may also be a component of a larger project proposal. For example, you may be proposing a complex software system project that includes descriptions of equipment, installation details, staffing, and so on. A complex proposal like this may also include a subset of topics for training.

In this case, you will follow the basic structure outlined here, but the Training Plan will most likely be listed as one section of the proposal.To help persuade clients, proposals should be visually appealing. Consider doing any or all of these to add graphics and splashes of color: incorporate your company logo, use colored borders on your pages, or select custom bullet points and fonts that match your business style. Because you are providing educational training, your proposal must be flawless. Carefully proofread and spell-check all the pages, and get someone who is unfamiliar with your proposal do the final proofreading pass, because it's easy to overlook mistakes in your own work.Finally, save your proposal and deliver it to your potential client. The best delivery method will depend on your business and your relationship with your potential client. Emailing PDF files to clients is a common practice; however, consider that a nicely printed, signed and hand-delivered proposal might impress the client more by showing you value that client enough to put in the extra personal effort. These days, too many businesses are automating everything possible and losing the personal touch.Now you know that all training services sales proposals follow a similar format and structure, and you can find all the topics you need in.

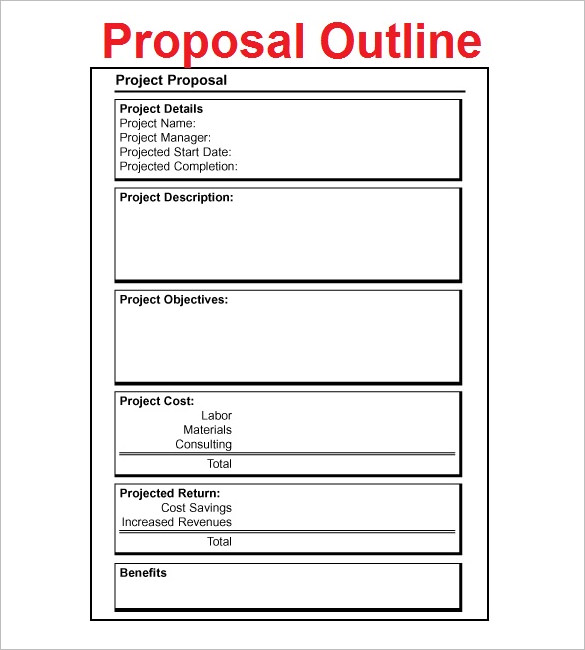

Project Proposal Template Word

The pre-written topic pages contain explanations of what those particular pages should contain. They will guide you in writing and formatting appropriate information for your proposal sections. Also contains a wide variety of training and educational sample proposals that will give you great ideas and help you get a jump start on writing your own winning proposal.